Ministry of Finance and the Public Service

Audit Committee Performance Evaluation guideline (ACPE tool)

Kingston, Jamaica: Tuesday, April 30, 2024

At the end of each month, the fiscal data on revenues and expenditures are uploaded to the Ministry of Finance’s website which is open and accessible to the public.

Today, we will upload the provisional revenues and expenditures recorded for the month of March 2024 which is the 12th and final month of the 2023/24 fiscal year.

The 2023/24 fiscal year covers the period April 1, 2023 to March 31, 2024 and with the March data we will also therefore upload the provisional revenues and expenditures recorded for the full 2023/24 fiscal year.

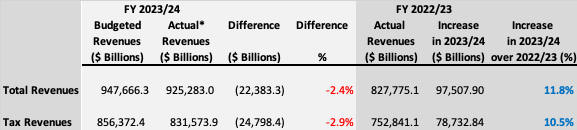

Revenue Outturn – Full Year 2023/24

Although total GOJ revenues for 2023/24 were $97.5 billion or 11.8% ahead of the prior fiscal year 2022/23, these revenues were less than budgeted by $22.4 billion.

Similarly, while Tax Revenues for 2023/24 were 10.5% or $78 billion ahead of the prior fiscal year 2022/23, these were less than budgeted by $24.8 billion.

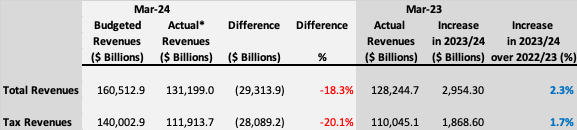

Revenue Outturn – March 2024

The revenue underperformance vs budget for the full year 2023/24 was primarily due to the revenue outturn for the month of March 2024.

Total Revenues for March 2024 were 2.3% higher than March of the previous year but $29.3 billion or 18% less than budgeted.

Tax Revenues for March 2024 were 1.7% higher than March of the previous year but $28 billion or 20% less than budgeted.

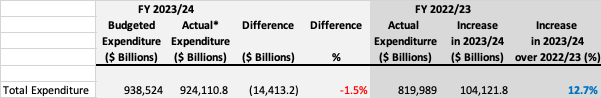

Expenditure Outturn – Full Year 2023/23

Total Expenditure in 2023/24 was 12.7% or $104.1 billion higher than in 2022/23.

However Total Expenditure for 2023/24 came in under budget by $14.4 billion or 1.5%.

Fiscal Balance – Full Year 2023/24

Although expenditure was below programmed levels by $14.4 billion, it was not enough to outweigh the revenue shortfall resulting in a fiscal surplus of $1.1 billion (0.04% of GDP) instead of the budgeted fiscal balance of $9.1 billion (0.3% of GDP).

Prior Downward Adjustment of 2023/24 Revenue Target

In January 2024 through the Fourth Supplementary Estimates, the revenue target for FY 2023/24 was adjusted downward by $1.9 billion. This adjustment envisaged a shortfall in tax revenues and grants. Despite this adjustment, however, the falloff in the March 2024 revenues was higher than expected.

Jamaica’s Debt Target

Although the targeted fiscal balance surplus was only 0.04% of GDP instead of 0.3% of GDP as programmed, the country should note that given the fiscal balance overperformance in FY 2021/22 (0.9% of GDP) and on the programme outturn in 2022/23 (0.3% of GDP), the downward trajectory of the debt toward the legislated 60% of GDP by FY 2027/28 is in fact slightly ahead of target and has not been adversely affected by the FY 2023/24 fiscal balance outturn.

Debt to GDP at end-March 2024 is estimated at 72.2% with an expectation that it will be in the mid-60s by end-March 2025, indicating that the trajectory to target is well within reach.

Analysis of Fiscal Year 2023/24 Revenue Outturn

Preliminary analyses of the revenue outturn for FY 2023/24 indicates the following:

Concluding Remarks

The underperformance of revenue in March 2024 has implications for the programmed revenue estimates for FY 2024/25. The Government has therefore commenced an assessment of the options to ensure prudent fiscal operations and the attainment of legislated targets.

As customary, the fiscal operations for the month of March 2024 and FY 2023/24 are available on the Ministry of Finance and the Public Service website: www.mof.gov.jm.

–30–

For further information contact:

Ministry of Finance and the Public Service

30 National Heroes Circle

Kingston 4

The Hon. Nigel Clarke, D.Phil., MP

Minister of Finance and the Public Service

30 National Heroes Circle, Kingston 4

Tel: (876) 932-4656 / 4660 / 4655

Eml: opedjamaica@gmail.com

Finance Minister, Fayval Williams, notes comments in the public domain concerning the appointment of Mr. Dennis Chung as Chief Technical Director (CTD) of the Financial Investigations Division (FID) and a proposal that the Government inserts itself into the process by over-turning the recommendation of the Office of the Services Commission (OSC).

Finance Minister, Fayval Williams, notes comments in the public domain concerning the appointment of Mr. Dennis Chung as Chief Technical Director (CTD) of the Financial Investigations Division (FID) and a proposal that the Government inserts itself into the process by over-turning the recommendation of the Office of the Services Commission (OSC).

The Minister of Finance and the Public Service is pleased to announce the appointment of Mr. Dennis Chung as Chief Technical Director of the Financial Investigations Division (FID), effective June 2, 2025.

A Jamaica Teachers Association Memorandum dated April 23, 2025 to its membership from the Secretary General, Mark Nicely, stated that the Ministry of Finance and the Public Service had outlined that payments for the increments should be made during the first quarter of the 2025-2026 Financial Year.

Stay in the know with everything going on at the Ministry of Finance and the Public Service by subscribing the MOFPS INSIDER magazine.

Stay in the know with everything going on at the Ministry of Finance and the Public Service.